Business Insurance in and around Des Moines

Des Moines! Look no further for small business insurance.

Insure your business, intentionally

Coverage With State Farm Can Help Your Small Business.

Though you work so hard to ensure otherwise, it is good to recognize that some things are simply out of your control. Problems happen, like a staff member gets hurt on your property.

Des Moines! Look no further for small business insurance.

Insure your business, intentionally

Small Business Insurance You Can Count On

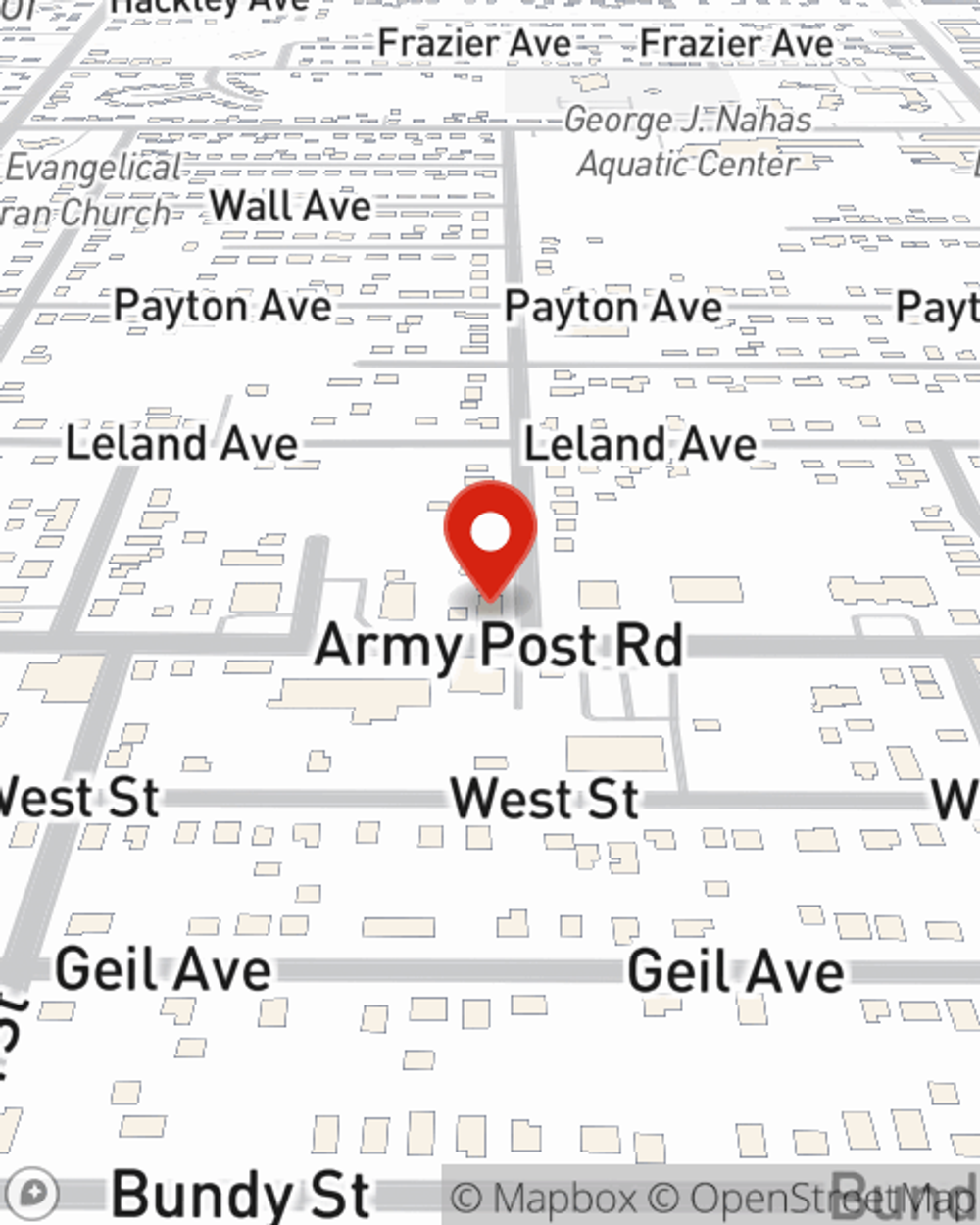

With State Farm small business insurance, you can give yourself more protection! State Farm agent Tony Weisshaar is ready to help you handle the unexpected with reliable coverage for all your business insurance needs. Such individual service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If you have problems at your business, Tony Weisshaar can help you file your claim. Keep your business protected and growing strong with State Farm!

Do what's right for your business, your employees, and your customers by reaching out to State Farm agent Tony Weisshaar today to identify your business insurance options!

Simple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

Tony Weisshaar

State Farm® Insurance AgentSimple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.